taxing unrealized gains janet yellen

Capital gains tax is a tax on the profit that investors realise on the sale of. One basic principle of income taxation in the United States is the wherewithal to pay.

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

May 19 2022 1135 AM 3 min read.

. Eagle-Keeper January 21 2021 951pm 1. Treasury Secretary Janet Yellen explained on CNN Sunday that the proposal raised by Sen. If Youre Looking for a Good Primer on Why Taxing Unrealized Capital Gains Is a Bad Idea.

Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US. Ron Wyden D-Oregon would impose an annual tax on unrealized capital gains on. Be sure to like and subscribe and hit the bell button for channel alertsSend Fan Mail with USPS ToCOMMANDER VLOGSPO BOX 643EAST OLYMPIA WA 98540Send Fan.

Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold. Janet Yellen proposes taxes on unrealized capital gains while Biden continues to push for 87000 new IRS workers. It is the theoretical profit existent on paper.

There is a principle in taxation that has been long-standing practice in the United States that financial wherewithal is key to a tax being owed. Not exactly sure how that would work especially if the next year. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealised capital gains.

Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds. Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized capital gains of the wealthiest Americans. Capital gains tax is a tax on the profit that investors realise.

Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed taxing unrealised capital gains. If you still owned the house when it was valued at 350000 as opposed to selling it you would have grossed. Answer 1 of 6.

Janet Yellen Discusses Unrealized Capital Gains Tax Proposal House Speaker Pelosi Approves. Janet Yellens recent proposal to tax unrealized capital gains has caused havoc amongst everyday crypto traders. For example perhaps you purchased a house at 300000 and sold it for 350000.

Total long term capital gain rate 567. Janet Yellen wants to tax your UNREALIZED GAINS. Janet Yellen Bidens nominee for Treasury Secretary said she would consider taxing such unrealized gains to boost government revenues reported Reuters.

Yellen made the remarks in response to a question from Tapper about whether a wealth tax should be part of how Democrats look to pay for Bidens 35. The introduction of a tax on unrealized capital gains will force investors to pay for the growth of the rate of cryptocurrencies even those that are passively lying in the wallet. Unrealized gain means the investment stockcryptoreal estateanything you bought that has gone up in value has.

The phrase unrealized capital gains has been trending on social media and. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealised capital gains. Bloomberg -- Treasury Secretary Janet Yellen rejected any idea that the Federal Reserve and its counterparts should boost their.

Capital gains tax is a tax on the profit that investors realize on the sale of their assets. After Janet Yellens comments this weekend. If the proposal of.

Jan 22 2021 - 204am. Government coffers during a virtual conference hosted by The New York Times. That means that the government expects people to pay the tax when they have the money.

Appearing on CNN Treasury Secretary Janet Yellen discussed the possibility of taxing UNREALIZED capital gains from wealthy individuals to help finance Bidens spending. Biden needs to raise money for his administrations goals. However as most crypto traders know this is not the first.

That sounds good until. Heres Janet Yellen talking about taxing unrealized capital gains otherwise known as how to destroy America Oct 25th 2021 231 pm Oct 25th. On September 28 2021 Federal Reserve Chairman Jerome Powell and US.

It looks like Janet Yellen would like to tax unrealized capital gains.

Biden S Cabinet Janet Yellen Considers Taxing Unrealized Gains R Accounting

Theranos Founder Elizabeth Holmes Takes Stand To Defend Herself In Fraud Case Holmes Elizabeth Guilty

Bloombergquint On Twitter Yes Taxation Of Unrealised Stock Market Gains Seems Unusual But It Is Already Embedded In The System Argues Shankkaraiyar Calling For A One Time Tax On Billionaires He Points To

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Does Treasury Secretary Yellen Really Want Unrealized Capital Gains To Be Treated As Income Swfi

No U S Won T Tax Your Unrealized Capital Gains Alexandria

Biden Says He Backs Tax On Billionaires Wealth

Janet Yellen Wants To Tax Unrealized Crypto Gains Youtube

Elon Musk Weighs In On Unrealized Capital Gains Tax Idea Channelchek

Janet Yellen Favors Higher Company Tax Signals Capital Gains Worth A Look Business Standard News

Treasury Secretary Janet Yellen Says Taxing Unrealized Capital Gains Is A Possibility Youtube

Janet Yellen S Idea To Tax Unrealized Capital Gains R Wallstreetbets

Yellen Describes How Proposed Billionaire Tax Would Work Including Yellen S Proposed Tax On Unrealized Gains In The Stock And Real Estate Market R Wallstreetbets

Yellen Argues Capital Gains Increase From April 2021 Not Retroactive Bloomberg

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too

Watch Two Experts Debate Joe Biden S Capital Gains Tax Proposal Youtube

What Is Unrealized Gain Or Loss And Is It Taxed

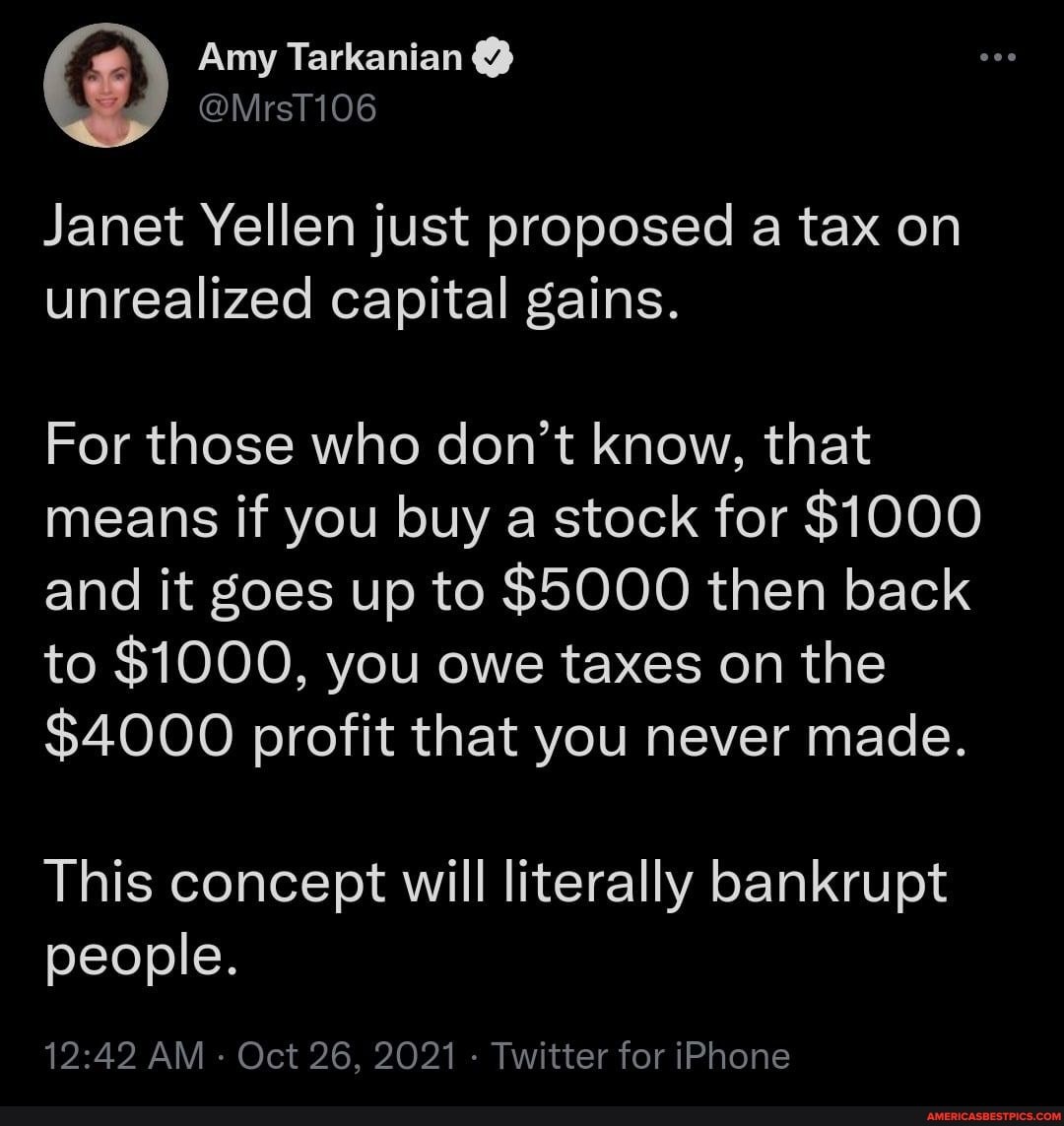

Janet Yellen Just Proposed A Tax On Unrealized Capital Gains For Those Who Don T Know

Avik Roy On Twitter Good Wsjopinion Summary Of The Constitutional Problems With The Dems New Proposed Wealth Tax On Unrealized Capital Gains Unrealized Capital Gains Aren T Income And The Constitution Only